Should We Give Our Kids an Allowance?

Do we need to give our kids an allowance? An all too familiar question that I believe every parent will ask once their child shows an interest in spending money. Or worse, they hear about other children who DO get an allowance and how it’s “so unfair!” that they don’t get an allowance.

So what is an allowance? It is a long word that savvily disguises its true meaning—to pay your child for existing. According to the American Institute of CPA’s, the monthly allowance for kids in 2019 averaged around $120.

Excuse me while I pick my jaw up off the floor.

Most parents tie chores or other jobs to earning allowance money. Some parents give it freely without requiring anything in return.

There was a time when we did give our kids an allowance, which was tied to chores. Like many parents, we fell off of it after about a month. Our kids were ages 6 and 4 at the time, and we wanted to encourage them to make their beds, pick up their toys, eat all of their supper and get ready for bed when asked to do so without complaining.

Each day they could earn a nickel, and by the end of the M-F week, they’d get a quarter. Yes, they always earned a quarter because we were not about to let our adorable, sweet babies fail! By not allowing them to experience simple failure, we failed as parents. Ultimately though, it came down to money. We use plastic for most everything, and we never kept enough loose change on hand, and we let the whole thing fizzle out.

Now let’s backtrack and imagine we succeeded for an entire year with the kids and their allowance. By the end of the year, the boys would have made $13 each. For a 6 and 4 year old, that’s a lot of money. But for a 12-year-old? That’s chump change and not even worth the effort.

I can’t fathom giving our oldest three children an allowance of even $50 a month, much less $120. That’s over $1400 a year for just one kid! Factor in giving an allowance to three kids, now we’re talking over $4k a year. Kiss my single-family income goodbye.

The thought of it has me sweating bullets.

We have our reasons not to give our kids an allowance. There are some good reasons TO give our kids an allowance. Let’s explore why we don’t give our kids an allowance and questions to consider if you decide you want to give your kids an allowance.

Why don’t we give our kids an allowance?

1. Selfcare

Teaching the value of money is great, but if my kids can’t learn to value themselves, take care of their personal hygiene, and the home in which they live, money is way down on the list of things I need to teach my kids.

No one gives me an allowance for brushing my teeth or loading the dishwasher, so why should my kids get one for those things? By paying our children to take care of themselves, we devalue the satisfaction and pride that one receives from a job well done. Those qualities are no longer valuable if we give our kids money in their place.

My wife’s favorite line from the movie The Good Dinosaur is, “This is our home, and we will take care of it together.” By paying our child to take care of himself, we teach him that nothing is worth doing if he does not get some kind of physical reward from it. I believe this will set our kids up to have a self-serving mindset instead of a self-giving mindset.

2. We are the providers.

There is certainly value in putting in a good day’s work and earning money for it. As a parent, that is my job. I put in a good day’s work, and I earn money for it. My children need to stay children for now.

3. There’s more than one way to teach financial responsibility.

Though an allowance can teach specific financial values, an allowance isn’t the only way to teach them. Children can earn money through working for family members and neighbors, getting a job if they are of age, and just saving any money they may receive from special occasions.

We most certainly want to teach our kids how to balance their desire for things, their goals, the things they need, and how that all ties into the money they have on hand. Financial responsibility is a valuable quality to have. Angela and I were both minimally financially literate when we were young adults, and we don’t want that for our children.

Right now, we include our children in some factors of why we spend in some areas and why we don’t spend in others.

When Angela takes the kids grocery shopping, and they ask for a particular cereal, she’ll point out the price of that cereal brand versus the price of another cereal brand. It helps put into perspective what is considered expensive in that food category and what isn’t. It also teaches them to shop around for the best deal. She also talks to them about sales, coupons, and purchasing what is healthy and needed for the week’s menu.

I use at-home examples to teach our kids about budgeting and saving money. If the lights are left on, that makes the electric bill go up. If the electric bill goes up, we won’t be buying pizza from their favorite pizza joint next month because we now have to compensate for the increased electric bill.

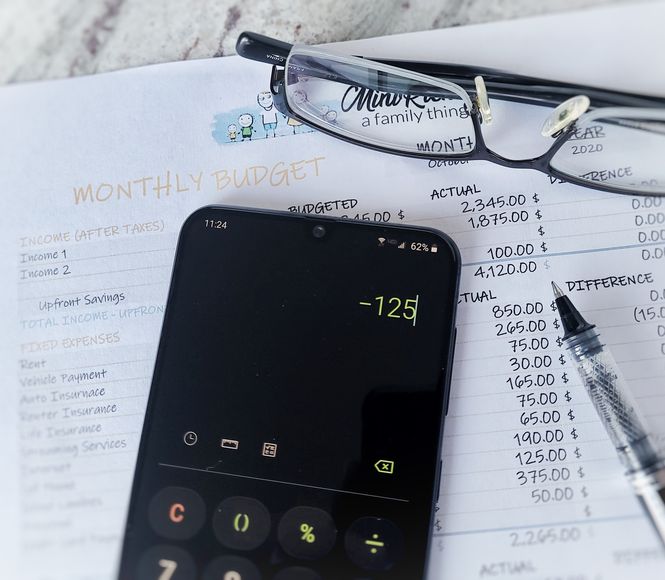

Once our children are of age, we will introduce them to our monthly budget template and teach them how to use it in their circumstances.

4. No room in the budget.

We may want to give our kids an allowance, but we’re a large family and it just isn’t financially responsible on our part. We’re an average single-income family, and trying to give our kids an allowance comparable to the national average would drain a good chunk of our monthly savings.

It makes us so happy to see our kids make purchasing, donating, and savings decisions that bring them joy. However, it is more important that we save this money towards emergencies, our retirement, and future purchases—like a car for when we have another driver!

Things to consider when deciding if giving an allowance is right for you.

1. Make sure it is in your budget.

What? You don’t have a family budget? Head on over to our blog post about creating a family budget to get started. Sign-up and you’ll receive the budgeting sheet we’ve been using for years!

Now that you’ve figured out your budget, check and see if there is room in it to give your kid an allowance. Do you have room to spend X amount of money on your child each month?

Will you be able to keep it up for the next several years until your child gets a job?

Will you be able to do the same for the next couple of kids that come of age to receive an allowance?

All are critical questions to consider and answer before committing to giving your kids an allowance.

2. Be clear with your intentions.

Have a clear idea ahead of giving your kid an allowance of how you want this all to play out.

Is this free-spending money? Does your child decide what gets saved, donated, or spent? Do you have percentages set for your child’s allowance dedicated to saving, donating, and spending? Will you teach your child about taxes through their allowance?

Will you set aside time each week or month to go over all of these things with your child, or will you leave it up to your child to remember to put the money where it goes?

3. Money has more value than what meets the eye.

Assuming you are giving an allowance as a financial teaching tool, then it is good to teach your child that money is the result of giving your time. As you go to work and receive money for your time and efforts there, your child will also have to give up their time to complete chores and earn the cash they desire.

4. Discuss with your child their intentions for their allowance.

Your child may be way too thrilled to realize the gravity of receiving an allowance.

Remember, with great power comes great responsibility.

—Uncle Ben in Spiderman

Help your child come up with short and long-term savings goals. To help, we’ve created a kid-friendly budget worksheet!

You can sign up on our little yellow form here, and we’ll send you the blank copy of our kid-friendly budget worksheet for free.

With our kid-friendly budget worksheet, your child can fill in the income they receive each month. It is a 2-month budget tracker to aid them in learning financial responsibility. They will fill in any allowance they receive, payment for work performed for the neighbors, or money earned from chores.

Next, they will fill in any expenses they incur that month. Donating, saving, buying popcorn at the movie theater or small toy while at the store are examples of costs your child would write in and keep track of.

Finally, your child can tally the earnings, expenses, and overall savings at the end of two months.

Maybe your 10-year-old wants a cool set of headphones. This kid-friendly budget worksheet can help her determine how long it will take to save for that item.

Consider that headphones go on sale during the holidays, and it would be financially frugal to wait until then. Or, maybe she could put in extra work to earn more cash sooner if a holiday sale is just around the corner.

5. Help your child stay on track.

It is hard enough as an adult not to impulse buy things we like or think we need. Ask your child how their budget is coming along. Review our kid-friendly budget worksheet with him. Remind him of how proud you are that he is sticking to his goals and not buying Oreos each week at school.

Having money and not spending it is a great way to teach self-control, patience, and delayed gratification. These are beneficial qualities to have as an adult. We all know that things worth having in life never come easy. Learning these character traits early in life can help ease the stresses of adulthood.

Encourage your child through setbacks. If he buys an item that wasn’t planned for, talk with him about it. Maybe he kept the receipt and can return it. Perhaps he thinks it is worth having but didn’t realize he would be putting his goals off for a little bit longer—talk it out.

I was just considering giving my kids (6 and 5) an allowance for helping me around the house (single mom here), but I have a very strict budget so I wasn’t sure how I was going to do that. I already told them their father and I put money in separate accounts for their college funds but they don’t really care lol! I thought giving them an allowance would help them understand the value of money, but you made very good points. You are right, there are other ways to do it, so I think I’m gonna show them my monthly budget to help them understand why we can’t get McDonald’s every day (other than the obvious health reasons!). Thank you for sharing 🙂

Each of our children has a savings account, but we’ve had a similar experience with our younger children not grasping the bank account concept! I believe they have difficulty understanding the number on the screen equaled green money in their bank account. We started our own bank here at home to help. We wrote each of their names on an envelope and placed them in our home safe that only my wife and I know the combination to. Whenever they receive cash, my wife or I open the big safe door. They then get to pull their envelope out, put the money in, and then shut the big safe door. I feel like this helps them understand what a bank account does for when they are on the older side of the teenager years.

This is a really helpful perspective! I haven’t thought about an allowance for kids yet, but now I have some good points when I need to.

We’re always super happy to hear we’ve been helpful!

I believe that giving children an allowance can help instill positive money habits. However, I think allowances shouldn’t be tied to chores, and in this respect completely agree with you. Kids do need to learn how to be responsible.

I couldn’t agree more. I also believe many other things can help instill positive money habits, such as teaching your older children how to create a monthly budget.